We have just deployed the period-based VAT for Europe.

This is to accommodate the use cases where:

– A seller is not VAT registered for a period of time when just starting a new business

– A seller has exceeded the VAT threshold, registers for VAT and starts charging VAT from the date of registration

– A seller changes from the Flat VAT Rate Scheme to the Standard VAT Rate Scheme or vice-versa

– A seller falls below the VAT thresholds and ceases to charge VAT

– The tax authorities change their VAT rate (heard the one about Brexit, Y’all?)

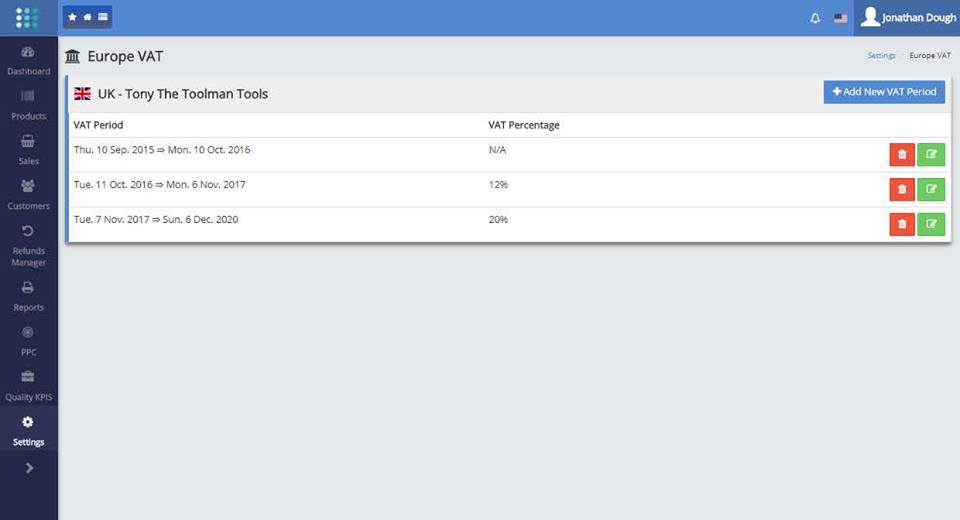

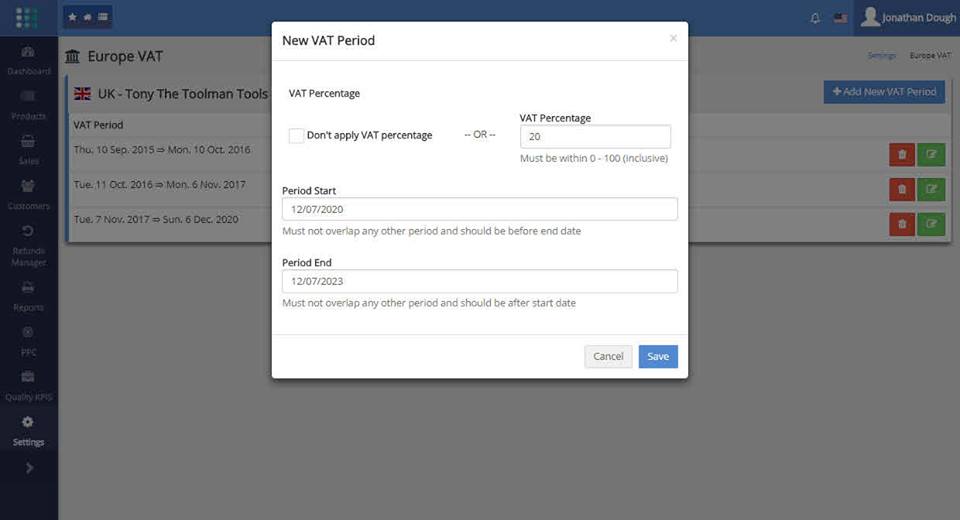

Period-based VAT behaves like period-based COGS, whereby a specific VAT rate is applied to the orders received between the two boundary dates specified in the settings.

There is a setting at the level of the marketplace as a whole, but of course, you can also define a period-based VAT rate at an individual product level, which then overrides the marketplace VAT rate.

The marketplace and product level date ranges are independent. This provides the added flexibility be able to assign overlapping date ranges at the product level. In essence, the date ranges at product level trump the date ranges at marketplace level.